Business Plans and Budgets

Oxford County Council approved the 2025 Business Plan and Budget on December 11, authorizing a total budget of $413.3 million, made up of a $288.1 million operating budget and $125.2 in capital projects.

Oxford County Council approved the 2025 Business Plan and Budget on December 11, authorizing a total budget of $413.3 million, made up of a $288.1 million operating budget and $125.2 in capital projects.

The 2025 Budget focuses on upholding health services (long-term care and paramedics), investing in roads and water and wastewater infrastructure, and carrying out special projects to meet the goals of the 2023-2026 Strategic Plan.

- Download the approved 2025 Business Plan and Budget

- Read the news release

- Learn more about the 2025 Budget process

About the 2025 Budget survey

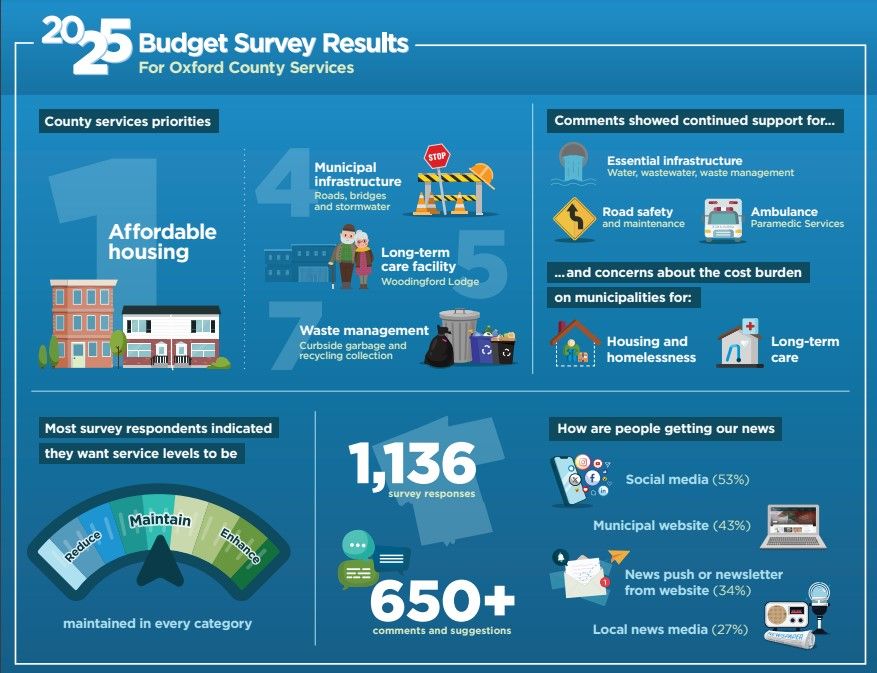

The 2025 Budget survey was open for public feedback from June 12 to August 30, 2024. The annual survey is an opportunity for residents to have a say on which services should be a priority in the upcoming budget year.

The 2025 Budget survey was open for public feedback from June 12 to August 30, 2024. The annual survey is an opportunity for residents to have a say on which services should be a priority in the upcoming budget year.

A total of 1,136 people responded to the budget survey this year, with 62% indicating the value they receive for County tax dollars is fair or good, and 24% indicating they receive poor value. More than 650 comments were received through the survey, spanning housing, children’s services, long-term care, paramedic services and roads.

For more information or to see the survey results, visit Speak Up, Oxford!

Infographic: Highlights from the 2024 Budget Survey - Oxford County results

Oxford County's annual business plan and budget is guided by Council’s strategic priorities as set out in the Strategic Plan. The County's fiscal year is from January 1 to December 31.

Oxford County residents do not pay taxes directly to the County. The County tax levy is added to the tax bill in each area municipality and then transferred to the County from Blandford-Blenheim, East Zorra-Tavistock, Ingersoll, Norwich, South-West Oxford, Tillsonburg, Woodstock and Zorra. The County's annual budget is then financed by these tax levies as well as government funding, reserve funding, and fees from development charges, water and wastewater, etc.

Tax levies collected by the County are used to:

- maintain and manage County infrastructure, including bridges and highways, drinking water, wastewater, and garbage and recycling;

- deliver social services, ambulance, and long-term care services directed by the provincial government;

- provide development and community planning for each area municipality and the County as a whole;

- maintain county-wide information systems, library services and archives; and,

- administer the Provincial Offences Court.