Business Plans and Budgets

2024 Business Plan & Budget

Oxford County's 2024 Business Plan and Budget was approved on December 13, 2024, with the interim budget levy bylaw passed on January 10, 2024.

Oxford County's 2024 Business Plan and Budget was approved on December 13, 2024, with the interim budget levy bylaw passed on January 10, 2024.

Through a total budget of $349.5 million ($245.9 million operating budget and $103.6 million capital plan), Oxford County’s 2024 business plan invests in initiatives that meet its mission to improve Oxford’s social, environmental, and economic well-being.

This includes programs and services that provide affordable housing, support for vulnerable and unhoused people, safe drinking water, traffic calming and road safety, and community paramedicine to redirect some types of care from emergency rooms. It also supports Oxford County in meeting new requirements and directives under Ontario’s Fixing Long-Term Care Act; staffing to support the increased demand for services; and preparing waste management programs for upcoming provincial changes.

- Download the FINAL 2024 Business Plan and Budget (Jan 10, 2024)

- Read the news release: Oxford County approves 2024 Business Plan and Budget (Dec 13, 2023)

2024 Budget process

Each new Council term, Oxford County's Strategic Plan establishes the goals, objectives and initiatives that individual department budgets must support.

The Draft 2024 Business Plan and Budget was released at County Council on November 8, 2023, followed by special budget meetings on November 15 and November 29. Final consideration of the budget for approval took place at the regular County Council meeting on December 13, 2023.

For more information, including presentations and video recordings of special budget meetings, visit Speak Up, Oxford!

About the 2024 Budget survey

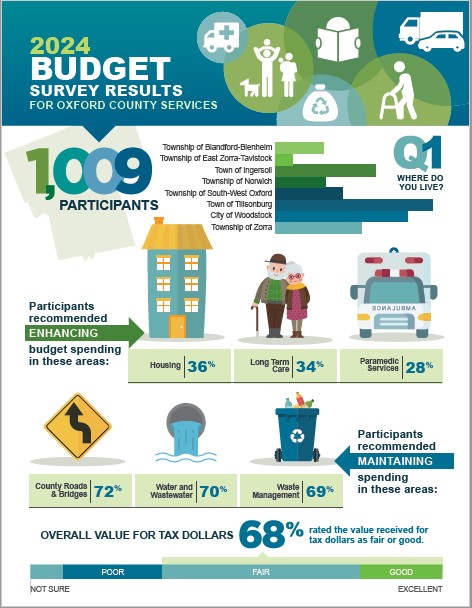

The 2024 Budget Survey was the community's opportunity to have a say on municipal budgets for the coming year. This year's budget survey ran from June to August, 2023. Read the highlights

The 2024 Budget Survey was the community's opportunity to have a say on municipal budgets for the coming year. This year's budget survey ran from June to August, 2023. Read the highlights

The survey results for Oxford County were before County Council on September 27, 2023. Key findings from the survey include:

- More than 500 comments and suggestions were received through 1,009 responses to the online public survey.

- Of those who responded, 68% said they receive "fair" or "good" value for their tax dollars.

- The majority of respondents felt that each of the services should be at least maintained at the current service levels.

Infographic: Highlights from the 2024 Budget Survey - Oxford County results

About the Oxford County budget and tax levy |

|

Oxford County's annual business plan and budget is guided by Council’s strategic priorities as set out in the Strategic Plan. The County's fiscal year is from January 1 to December 31. Oxford County residents do not pay taxes directly to the County. The County tax levy is added to the tax bill in each area municipality and then transferred to the County from Blandford-Blenheim, East Zorra-Tavistock, Ingersoll, Norwich, South-West Oxford, Tillsonburg, Woodstock and Zorra. The County's annual budget is then financed by these tax levies as well as government funding, reserve funding, and fees from development charges, water and wastewater, etc.

|